Key Difference- Revenue vs Turnover

Revenue and turnover are two accounting terms that are often used interchangeably. In the United States, businesses use the term revenue with regard to how much income a company generates. In the United Kingdom, the term turnover is used for the same purpose. Thus, generally with regard to company’s top line (sales is recorded as the very first item on the Income Statement), revenue and turnover are regarded as synonyms. However, the term turnover is also used to describe certain main aspects with regard to current assets. Thus, the key difference between revenue and turnover is that while revenue is the sales income generated by a company, turnover assesses how quickly a business collects cash from accounts receivable or how fast the company sells its inventory.

CONTENTS

1. Overview and Key Difference

2. What is Revenue

3. What is Turnover

4. Side by Side Comparison – Revenue vs Turnover

5. Summary

What is Revenue?

Revenue refers to the income earned by the company by conducting business activities. If a company has many strategic business units, all of them will be revenue generating units for the company. In the income statement, revenue is recorded in the first line (top line).

Revenue is a key item considered in calculating a number of profitability ratios such as,

Revenue is considered as important as overall profit since,

- It reflects the strength of the businesses’ customer base and size of market share

- Growth in revenue showcases stability and confidence

- Banks need to see that the company is able to generate steady revenue from regular business activities to pass loans and favorable interest rates.

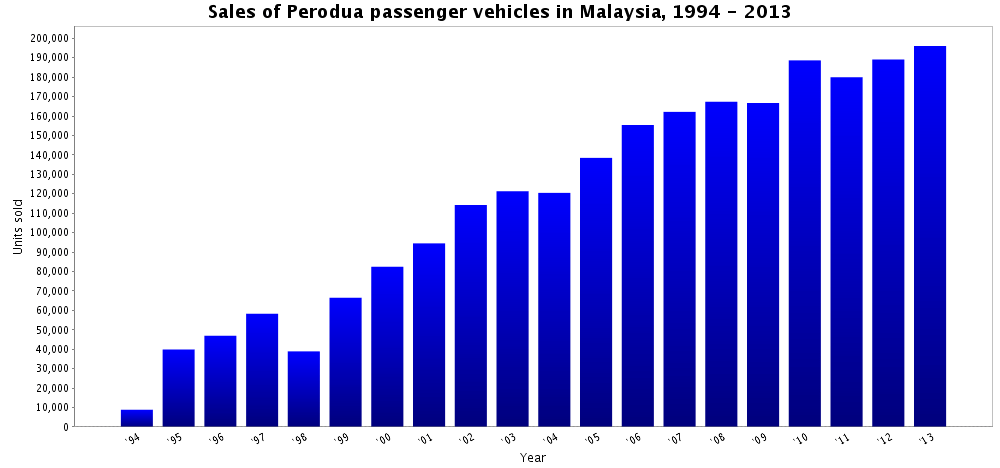

Figure_1: Steady revenue growth is vital to a company

What is Turnover?

Turnover is an accounting term that calculates how quickly a business collects cash from accounts receivables or how fast the company sells its inventory. Accounts receivable and inventory are the most important current assets to a business that play a main role in determining the liquidity position.

Accounts Receivable Turnover

This is the number of times per year that a company collects its average accounts receivable. When sales are done on a credit basis the customers owe funds to the company. The time granted for them to settle payments will depend on the relationships the business has with the respective receivables and the nature of the transactions. For instance, if the sum owed is relatively large, then the receivables will probably make payments in installments; thus it will take more time.

However, the sooner the company collects the funds the better; as these funds can be reinvested in the business without having the need to take additional credit to run operations. Furthermore, if receivables take a longer time to pay, possible situations of bad debts may occur as well. Accounts receivable turnover ratio is calculated as follows.

Accounts Receivable Turnover = Credit Sales / Average Accounts Receivables

Inventory Turnover

Inventory turnover is the number of times the company’s inventory is sold off and replaced with new inventory within the year. The time taken to sell the inventory indicates the level of demand that the company’s products have and this serves as a critical indicator of success. Inventory turnover ratio is calculated as per below.

Inventory Turnover = Cost of Goods Sold /Average Inventory

There are no ideal turnover ratios for accounts receivables and inventory as it predominantly depends on the nature of the industry. Retail industry is a good example to consider here since,

- Retail outlets hold significant amounts of inventory and their success depends on how fast the inventory is moving. Thus, inventory turnover is comparatively high in such retail contexts.

- Retail organizations mostly purchase goods from manufacturers on a credit basis and settle them once the goods are sold to customers.

Figure_2: Retail outlets have high Accounts receivable and Inventory turnover ratios

What is the difference between Revenue and Turnover?

Revenue vs Turnover | |

| Revenue is sales income earned over the accounting period | Turnover is the speed at which payments from receivables are obtained and inventory sold and replaced |

| Effect | |

| Revenue affects profitability | Turnover affects efficiency |

| Ratios | |

| Revenue is used to calculate Gross Profit Margin, Operating Profit Margin and Net Profit Margin | Turnover is used to calculate accounts receivables turnover and inventory turnover |

Summary – Revenue vs Turnover

Maximizing revenue remains a vital aspect that all organizations thrive to achieve in order to conduct sustainable business. Comparing revenue with previous periods and similar companies with the assistance of ratios enable important insights as to how the company is growing. For turnover, companies may maintain certain standards with regard to how much the receivables and inventory turnover should be since these largely depend on the nature of business. Although there is a difference between revenue and turnover, both are important concepts to a business.

Reference:

1. “Turnover.” Investopedia. N.p., 14 Mar. 2016. Web. 07 Feb. 2017.

2. “Accounts Receivable Turnover” AccountingTools. N.p., n.d. Web. 07 Feb. 2017.

3. “Inventory Turnover.” Investopedia. N.p., 26 Feb. 2016. Web. 07 Feb. 2017.

4. “Importance of Revenue.” Business & Entrepreneurship – azcentral.com. N.p., n.d. Web. 07 Feb. 2017.

Image Courtesy:

1. “Sales of Perodua passenger vehicles in Malaysia, 1994 – 2013 (b)”By Aero777 – Own work (Public Domain) via Commons Wikimedia

2. “1424043” (Public Domain) via Pixabay

ncG1vNJzZmivp6x7pbXFn5yrnZ6YsqOx07CcnqZemLyue8OinZ%2Bdopq7pLGMm5ytr5Wau26%2BxK%2Bcp62VYq6vsIyvqmaspae7sMLEq2Y%3D