Key Difference – Period Cost vs Product Cost

Period cost and product cost, as their names imply, are related to specific period and output, respectively. The key difference between period cost and product cost is that period cost is an expense that is charged for a time period in which it is incurred whereas product cost is a cost associated with products that a company manufactures and sells. The knowledge of these types of costs is important in order to correctly apply accounting treatments.

CONTENTS

1. Overview and Key Difference

2. What is a Period Cost

3. What is a Product Cost

4. Side by Side Comparison – Period Cost vs Product Cost

5. Summary

What is a Period Cost?

Period cost is an expense charged for a specific time period in which it incurred. These cannot be charged to the cost of goods sold in the income statement since these are not directly related to production; they are charged to the expenses incurred instead to support the production activity. A period cost can be any cost that cannot be capitalized into prepaid expenses, inventory, or fixed assets. Period costs are closely associated with the passage of time than at a transactional level. Since a period cost is essentially always charged to expense at once, it may more appropriately be called a period expense.

Common Examples of Period Costs

- Selling and distribution expenses

- Advertising expenses

- Administrative and general expenses

- Depreciation expense

- Commissions

- Rent

- Interest expense (interest that is not capitalised into fixed assets)

Costs associated with prepaid expenses (e.g., prepaid rent), inventory (e.g. direct materials) and fixed assets (capitalised interest) cannot be categorised as period costs. In general, some of the expenses may be paid in advance or in arrears; thus may include a portion of period cost.

E.g. TUW Company’s financial year end is 31st March each year. In April 2017, it made a rent payment of $ 18,000 to the landlord’s account to cover rent from April-September. Monthly rent expense is $3,000. In this situation, the only the rent for April will be considered as the period cost while the rent for May-September is a prepaid expense.

What is a Product Cost?

Product costs are applied to the products the a company produces and sells. Product costs refer to all costs incurred to acquire or produce the finished products. Examples of product costs include the cost of direct materials, direct labor, and overheads. Before these products are sold, the costs are recorded in inventory accounts on the balance sheet where they are treated as assets. When the products are sold, these costs are expensed as costs of goods sold on the income statement. Product costs are also referred to as ‘inventoriable costs’.

Job costing and process costing are widely used product costing methods that calculate the product costs associated.

Job Costing

Job costing calculates material, labour, and overhead costs assigned to a particular job. When individual products are unique and tailor made to the specific customer requirements, this method is used.

Process Costing

This method accumulates material, labour, and overhead costs across departments, then the total cost is allocated to individual units.

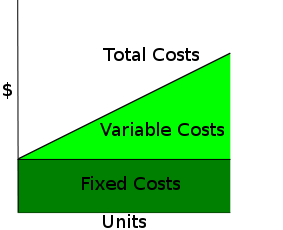

Figure 01: Direct and Indirect Costs amounts to total production cost

What is the difference between Period Cost and Product Cost?

Period Cost vs Product Cost | |

| Period cost is an expense that is charged for a time period in which it is incurred. | Product cost is a cost associated with products that company manufactures and sells. |

| Components | |

| Period costs exclude costs relating to prepaid expenses, inventories, and fixed assets. | Product costs include direct material, direct labour, and overhead costs. |

| Accounting Treatment | |

| Period costs are expensed to the income statement. | Product costs are initially recorded in the balance sheet as assets and expensed as cost of goods sold when the products are sold. |

Summary – Period Cost vs Product Cost

The difference between period cost and product cost is distinct in nature; period cost is related to a specific period and product cost is related to the output. Period costs are largely fixed costs in nature since they rarely change with the level of output and product costs are often variable in nature since their consumption is dependent on the level of output.

References:

1.”What is a period cost? – Questions & Answers.” AccountingTools. N.p., n.d. Web. 22 Mar. 2017.

2.”Product Costs vs Period Costs • The Strategic CFO.” Creating Success Through Financial Leadership. N.p., 13 Feb. 2017. Web. 22 Mar. 2017.

3.”What are the alternative product costing methods? – Questions & Answers.” AccountingTools. N.p., n.d. Web. 22 Mar. 2017.

4.”Production Cost.” Investopedia. N.p., 05 June 2015. Web. 22 Mar. 2017.

Image Courtesy:

1. “CVP-TC-FC-VC” By Nils R. Barth – Self-made in Inkscape.This vector image was created with Inkscape. (Public Domain) via Commons Wikimedia

ncG1vNJzZmivp6x7pbXFn5yrnZ6YsqOx07CcnqZemLyue8OinZ%2Bdopq7pLGMm5ytr5Wau268xKugqJxdmLy0wIyapZ1lpqh6sb7OnaycrF2YvLTAjg%3D%3D