Key Difference – PAN vs TAN

Tax payments by individuals and corporates is a main source of income for governments. As a result, governments continuously attempt to improve the ways of collecting tax efficiently. PAN (Permanent Account Number) and TAN (Tax Deduction and Collection Account Number) are two identifiers issued by the Income Tax Department of India, and each consists of a 10 digit alphanumeric code that relates to income tax. PAN and TAN are very similar to Social Security Number (SSN) in the USA. The key difference between PAN and TAN is that PAN is a unique 10 digit alphanumeric code that every taxpayer in a country must have and is mandated by law whereas TAN is a unique 10 digit alphanumeric code issued for individuals who are responsible for deducting or collecting tax as a mandatory requirement.

CONTENTS

1. Overview and Key Difference

2. What is PAN

3. What is TAN

4. Side by Side Comparison – PAN vs TAN in Tabular Form

5. Summary

What is PAN?

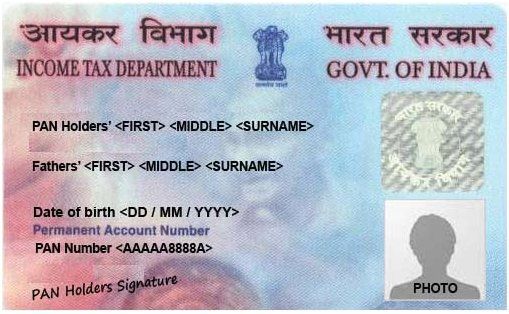

PAN (Permanent Account Number) is a unique 10 digit alphanumeric code that every taxpayer in a country must have and is mandated by law. It is issued by the Income Tax Department under section 139A of Income Tax Act, 1961. The structure of a PAN consists of 5 alphabets for the first 5 characters, 4 numerals for the subsequent 4 characters and an alphabet for the last character. The main purpose of PAN is to provide a unique identifier for all transactions of each taxpayer including tax payments and tax allowances. Once a taxpayer has obtained a PAN, it is valid throughout India for the lifetime of the taxpayer. Individuals who meet the following criteria must have a PAN.

- Individuals who earn a taxable income during the year as follows.

- Rs5 lakhs or more if the individual is below the age of 60 years

- Rs3 lakhs or more if the individual is above the age of 60 years

- Rs5 lakhs or more if the individual is above the age of 80 years

- Individuals who are entitled to receive any income, after deducting tax at source

- Individuals who are liable to pay excise duty (tax on sale of a specific good or a tax on a good produced for sale within a country for specific activities)

Figure 01: PAN (Permanent Account Number)

What is TAN?

Similar to PAN, TAN (Tax Deduction and Collection Account Number) is also a unique 10 digit alphanumeric code issued for individuals who are responsible for deducting or collecting tax as a mandatory requirement. TAN is also issued by the Income Tax Department under section 192A of Income Tax Act, 1961. The main objective of TAN is to simplify deduction and collect tax at source. The structure of TAN consists of 4 alphabets for the first 4 characters, 5 numerals for the subsequent 5 characters and an alphabet for the last character.

Further, as specified in the section 203A of the same act, it is mandatory to quote TAN on all tax deducted at source (TDS) returns. TDS is a means of indirect tax collection by Indian authorities according to the Income Tax Act, 1961. A penalty of Rs10,000 is payable upon failure to apply for TAN, as well as for failure to quote it in TDS returns documents.

Figure 02: India Currency

What is the difference between PAN and TAN?

PAN vs TAN | |

| PAN is a unique 10 digit alphanumeric code that every taxpayer in a country must have and is mandated by law. | TAN is a unique 10 digit alphanumeric code issued for individuals who are responsible for deducting or collecting tax as a mandatory requirement. |

| Purpose | |

| The purpose of PAN is to provide a unique identifier for all the transactions of each taxpayer including tax payments and tax allowances. | The purpose of TAN is to simplify deduction and collection of tax at source. |

| Code Structure | |

| The structure of a PAN consists of 5 alphabets for the first 5 characters, 4 numerals for the subsequent 4 characters and an alphabet for the last character. | The structure of a TAN consists of 4 alphabets for the first 4 characters, 5 numerals for the subsequent 5 characters and an alphabet for the last character. |

| Owned by | |

| PAN is owned by every taxpayer. | TAN is owned by every individual/entity who has to deduct or collect tax at source. |

Summary – PAN vs TAN

The difference between PAN and TAN is that PAN is a code designated for every taxpayer and TAN is a code issued for individuals who are responsible for deducting or collecting tax. At a glance, both PAN and TAN look very similar to each other since both are 10 digit alphanumeric codes. Furthermore, both are issued by the Income Tax Department of India. Unique identification codes such as PAN and TAN have made the calculation and collection of taxes convenient for authorities and made the tax system efficient and convenient to manage.

Download PDF Version of PAN vs TAN

You can download PDF version of this article and use it for offline purposes as per citation notes. Please download PDF version here Difference Between PAN and TAN.

References:

1. “Difference between PAN, TAN and TIN.” Bankbazaar. N.p., n.d. Web. Available here. 12 June 2017.

2. Sharma, Ashwini Kumar. “Did you know? The differences between your PAN and TAN.” Livemint, 18 Jan. 2017. Web. Available here. 12 June 2017.

3. “Difference between TIN, TAN, VAT, PAN, DSC and DIN.” IndiaFilingscom Learning Center. N.p., n.d. Web. Available here. 12 June 2017.

Image Courtesy:

1. “435450” (Public Domain) via Pixabay

2. “A sample of Permanent Account Number (PAN) Card” By PageImp – Own work (CC BY-SA 4.0) via Commons Wikimedia

ncG1vNJzZmivp6x7pbXFn5yrnZ6YsqOx07CcnqZemLyue8OinZ%2Bdopq7pLGMm5ytr5Wau268wKdkmqaUYsO0edOapWg%3D