Key Difference – Common Stock vs Retained Earnings

The key difference between common stock and retained earnings is that common stock is the shares that represent the ownership of the company by equity shareholders whereas retained earnings are a portion of the company’s net income which is left after paying out dividends to shareholders. Both these items are recorded under the equity section of the balance sheet. It is important to clearly identify the difference between common stock and retained earnings as they are different in their composition and purpose.

CONTENTS

1. Overview and Key Difference

2. What is Common Stock

3. What are Retained Earnings

4. Side by Side Comparison – Common Stock vs Retained Earnings

5. Summary

What is Common Stock?

Common stock is the shares that represent the ownership of the company by equity shareholders. Common stock is also synonymized as ‘common shares’, ‘ordinary shares’ and ‘equity shares’. The value of a share is referred to as the ‘par value’ or ‘nominal value’. The total value of the common stock is calculated as per below.

Value of Common Stock = Nominal Value per Share* Number of Shares

When common stock is offered to the general public for the first time, it is done through an Initial Public Offering (IPO) where the company is listed in a stock exchange for the first time and start trading shares. The main objective of issuing shares by a company is to gain access to a large pool of funds to attract investment opportunities. Subsequently, these shares will be traded in primary or secondary stock exchanges. An investor who is interested in purchasing shares of the company can do so by paying the market price of the shares, and the investor becomes a shareholder of the company.

Characteristics of Common Stock

Voting Rights

Common stock is entitled to voting rights of the company. Offering voting rights to equity shareholders allow them to avoid other parties involved in major decisions such as mergers and acquisitions and election of board members. Each share carries a vote. However, in some situations, certain companies may issue a portion of non-voting common stock as well.

Receipt of Dividend

Common stockholders are entitled to receive dividends out of profits earned. Dividends are received at a fluctuating rate since the dividends will be paid after dividend for preference stockholders are settled.

Risk

In a situation of company liquidation, all the outstanding creditors and preference stockholders will be paid off before common stockholders. Thus, the common stock carries higher risk in comparison with preference stock.

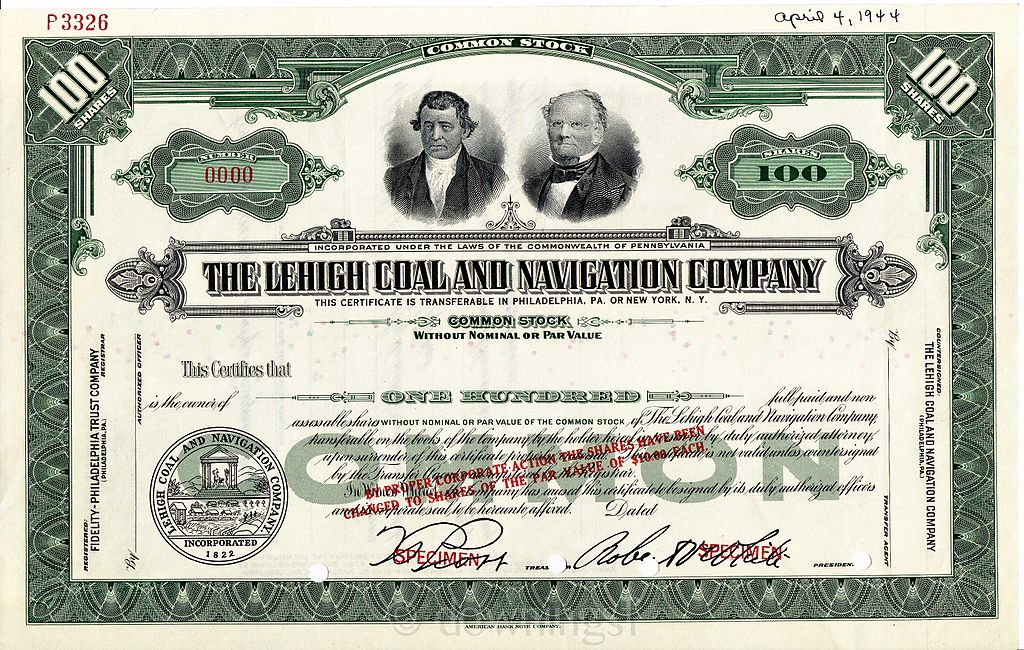

Figure 01: Common stock certificate

What are Retained Earnings?

Retained earnings are a portion of the company’s net income which is left after paying out dividends to shareholders. Retained earnings are reinvested in the business or used to pay off debt. These are also referred to as ‘retained surplus’. Retained Earnings can be calculated as,

Retained Earnings = Beginning Retained Earnings + Net Income – Dividends

The amount of retained earnings each year will be dependent on the dividend pay-out ratio and the retention ratio. The company may have a policy to maintain these two ratios at a specific level; for instance, the company may decide to distribute 40% of profits in the form of dividends and retain the remaining 60%, although this combination may change over time. If the company make a net loss in the current year but still intends to pay dividends, this can be done through the available profits in retained earnings accumulated over the years. Sometimes certain shareholders may claim that they do not wish to receive a dividend for a given year and would like to see more profits reinvested in the business which will facilitate extensive growth during upcoming years.

What is the difference between Common Stock and Retained Earnings?

Common Stock vs Retained Earnings | |

| Common stock is the shares that represent the ownership of the company by equity shareholders. | Retained earnings are a portion of the company’s net income which is left after paying out dividends to shareholders. |

| Purpose | |

| The purpose of common stock is to raise funds for business operations. | The purpose of retained earnings is to make reinvestments in the main business activity. |

| Formula | |

| Value of common stock can be calculated as (Nominal value per share* Number of shares). | Value of retained earnings can be calculated as (Beginning Retained Earnings + Net Income – Dividends). |

Summary – Common Stock vs Retained Earnings

The difference between common stock and retained earnings is that common stock indicates the share ownership of the company by equity shareholders while retained earnings are a portion of the company’s net earnings which is left after paying out dividends to shareholders. Common stock is always recorded at par value of the balance sheet irrespective of the market value. Retained earnings are considered as a significant asset by many companies since it assists investments by reducing the need to obtain debt.

Reference:

1. “Common Stock.” Investopedia. N.p., 02 Oct. 2014. Web. 16 May 2017. <http://www.investopedia.com/terms/c/commonstock.asp>.

2. “What Is Common Stock and What Is Preferred Stock? Stock Types and Their Differences Explained.” TheStreet. TheStreet, 07 May 2014. Web. 16 May 2017. <https://www.thestreet.com/story/10396922/1/what-is-stock.html>.

3. “Retained Earnings.” Investopedia. N.p., 30 Sept. 2015. Web. 16 May 2017. <http://www.investopedia.com/terms/r/retainedearnings.asp>.

Image Courtesy:

1. “Lehigh Coal and Navigation Company Stock Certificate” By Downingsf – Own work (CC BY-SA 3.0) via Commons Wikimedia

ncG1vNJzZmivp6x7pbXFn5yrnZ6YsqOx07CcnqZemLyue8OinZ%2Bdopq7pLGMm5ytr5Wau26vzqakqKZdqMGwr8pmmKecXavAbr7ErZiippWZeqat0aegp5%2BjZA%3D%3D