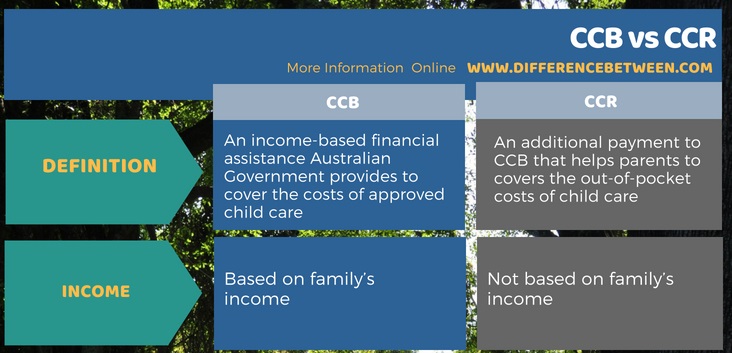

The key difference between CCB and CCR is that CCB (Child Care Benefit) is based on the family income whereas CCR (Child Care Rebate) is not based on the family income.

CCB and CCR are two types of financial assistance the Australian Government provides the families in order to cover the costs of approved child care. It is important to note that CCR is an additional payment to the CCB. Moreover, even if your family’s income is too high for you to receive CCB, you may still be eligible for CCR.

CONTENTS

1. Overview and Key Difference

2. What is CCB

3. What is CCR

4. Similarities Between CCB and CCR

5. Side by Side Comparison – CCB vs CCR in Tabular Form

6. Summary

What is CCB?

CCB or Child Care Benefit is a form of financial assistance Australian Government provides for families to cover the costs of approved child care. This service, however, is based on your family income. This is typically paid directly to the approved child care services so that the fees eligible families pay is reduced.

Online Estimator provided by the Department of Human Services can estimate the benefit you could receive based on your specific details. You can use this estimator to check whether you are eligible for (CCB) and the payments based on your current circumstance.

Eligibility Criteria

- The child must attend approved child care or registered child care

- Your or you must meet the residency and child’s immunisation requirements

- You must be the person responsible for paying the child care fees

You can apply for the Child Care Benefit (CCB) through the Department of Human Services. For this, you can either go in person or apply online.

What is CCR?

CCR or Child Care Rebate is an additional payment to CCB. In other words, you must have applied and been assessed as eligible for CCB in order to receive CCR. However, you can receive CCR if your entitlement for CCB is zero due to income. Most importantly, CCR is not income-tested; thus, there is a chance for you to receive CCR even if you don’t receive CCB. This pays up to 50% of your out of pocket expenses up to a limit of $7500 per child per year. Moreover, there is no separate application procedure for CCR. Once you have applied for CCB, the Department of Human Services will automatically assess your eligibility for CCR.

You can receive CCR in few ways: it can be a fortnightly, quarterly or annual payment to your bank account. If not, it can be also paid fortnightly to your child care service as a fee reduction.

What are the Similarities Between CCB and CCR?

- The amount of CCB or CCR you receive will depend on your circumstances.

- CCB and CCR will be replaced by one new Child Care Subsidy from 2 July 2018.

What is the Difference Between CCB and CCR?

CCB is an income-based financial assistance Australian Government provides to cover the costs of approved child care. CCR is an additional payment to CBR that helps parents to covers the out-of-pocket costs of child care. The difference between CCB and CCR is that CCB is based on family income, whereas CCR is not. Thus, a family whose income is too high to receive CCB may still be eligible for CCR.

Summary – CCB vs CCR

CCB (Child Care Benefit) and CCR (Child Care Rebate) are two types of financial assistance the Australian Government provides families in order to cover the costs of approved child care. CCB is based on family income, whereas CCR is not. This is the basic difference between CCB and CCR. It is also important to note that this child care assistance will change from July 2nd, 2018. A new child care subsidy will replace both CCB and CCR.

Reference:

1.“Child Care Benefit and Child Care Rebate.” Australian Government. Available here

2.“New Child Care Package | Department of Education and Training, Australian Government.” Department of Education and Training. Available here

Image Courtesy:

1.’2412780′ by geralt (CC0) via pixabay

ncG1vNJzZmivp6x7pbXFn5yrnZ6YsqOx07CcnqZemLyue8OinZ%2Bdopq7pLGMm5ytr5Wau26vwptkmqaUYrCkvo4%3D