Key Difference – Branch vs Subsidiary

Companies pursue organic and inorganic growth strategies in order to expand and obtain more market share. Branch and subsidiary are two commonly utilised methods by businesses to expand. A branch is an extension of the parent company (the entity making the investment) that carries out similar business operations whereas a subsidiary is a business where the parent company holds majority shares, thus have a controlling stake. This is the key difference between branch and subsidiary.

CONTENTS

1. Overview and Key Difference

2. What is Branch

3. What is Subsidiary

4. Side by Side Comparison – Branch vs Subsidiary

5. Summary

What is a Branch

A branch office is considered to be an extension of the parent company and is not considered a separate legal entity. This means that the entity is not considered to be separate from the owners by taking the form of a limited liability company or a corporation. Since a branch is not a separate legal entity, its liabilities extend to the parent company, meaning the parent company can be sued in a legal matter.

Branches are opened in order to have a presence in a wider geographical area, which allows the customers to enjoy easy access to the products and services of the company. More branches facilitate higher market share for the company. A branch is a new investment where the parent has to commit with capital, human and other operating resources in its incorporation.

A Branch conducts the same business operation as the parent company. The branches may be small, medium or large scale; however, their vision, mission, and operating criteria are similar to the parent company, and all the entities share a common goal and work towards achieving the same.

E.g. HSBC, one of the world’s largest banks, operates over 4,000 branches in 70 countries. All the branches operate under the same policies

What is a Subsidiary

Unlike a branch, a subsidiary has its own legal status; therefore, it is considered as a separate legal entity. Subsidiary conducts its own business operations and liabilities, and legal claims cannot be passed on to the parent. Making a substantial investment in an unknown market can be a significant risk that many companies are not willing to take. This risk can be mitigated by acquiring an already established corporation. If the parent company purchases a stake that exceeds 50% in another company, the latter becomes a subsidiary of the parent, allowing the parent to exert control over the subsidiary. Investing in a subsidiary increases the corporate value by strengthening the position of the parent.

A subsidiary may or may not carry out the same business operation as the parent. If a company may purchase another entity similar to its own, it is usually with the intention of combating competition.

E.g. If Carlsberg buys a controlling stake of Heineken (both are brewing companies); the competition for Carlsberg will reduce since both companies sell similar products to the same customer base.

Many companies are enthusiastic about acquiring a subsidiary situated in the same supply chain as the company itself. This can be in the form of ‘backward integration’ (acquiring a firm that supplies inputs or products to the company) or a ‘forward integration’ (acquiring a firm that distributes the company’s product to the customers)

E.g. If Wal-Mart acquires a controlling stake in Kellogg’s, a multinational food manufacturer; this is classified as a backward integration. Similarly, if Wal-Mart purchases a controlling stake in DHL, a logistics company; this is referred to as a forward integration.

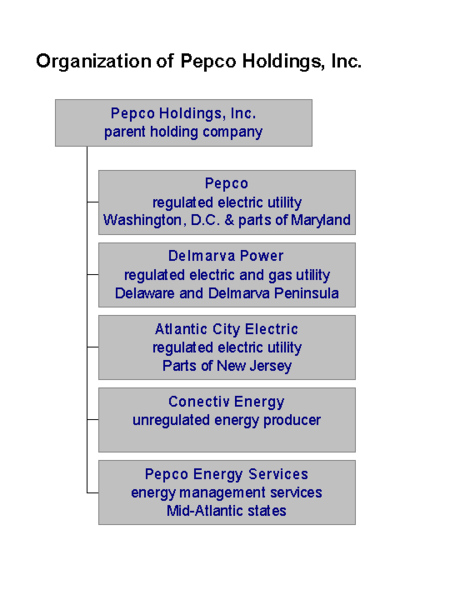

Figure 2: Large corporations often hold more than one Subsidiary

What is the difference between Branch and Subsidiary?

Branch vs Subsidiary | |

| A branch is an extension of the parent company opened to carry out the same business operation as the parent company. | Subsidiary is a business where the parent company holds majority shares, thus have a controlling stake. |

| Separate Legal Entity | |

| A Branch is not considered to be a separate legal entity. | A Subsidiary is a separate legal entity. |

| Growth Strategy | |

| Branch is a method of organic growth. | Subsidiary is considered to be an inorganic way to expand. |

| Ownership by the Parent | |

| Branch is a 100% investment by the parent. | Holding in a Subsidiary can be between >50%-100%. |

| Exit Criteria | |

| If a Branch is not generating profits, it can be closed down. | If a Subsidiary is not generating intended profits, it can be sold off. |

Summary – Branch vs Subsidiary

The difference between branch and subsidiary depends on a number of reasons as explained above. If managed properly, both can generate attractive returns to the parent company. Purchasing a subsidiary is often a costly investment than investing in a branch; however, it can assist the parent to obtain wider strategic benefits. Investing in branches is also equally important in order to acquire and serve a growing customer base. When the parent intends to open a branch or purchase a subsidiary in another country, this can comprise of a complicated legal structure.

Reference:

1. “Singapore Branch vs Subsidiary vs Rep Office.” GuideMeSingapore. N.p., n.d. Web. 28 Feb. 2017.

2. “J-Seed Ventures, Inc.” Market Entry – J-Seed Ventures, Inc. N.p., n.d. Web. 28 Feb. 2017.

3. Mottram, Nabarro LLP -Jim. “Choosing between a UK subsidiary and a UK branch.” Lexology. N.p., n.d. Web. 28 Feb. 2017.

4. “The Advantages & Disadvantages of Creating Subsidiary & Operating Companies.” Chron.com. 28 Sept. 2011. Web. 28 Feb. 2017.

Image Courtesy:

1. “Allied Bank Branches in Pakistan” By Fast_track (talk) (Uploads) – Own work (CC BY 2.5) via Commons Wikimedia

2. “Pepco Holdings org chart for subsidiary compenies” (CC BY-SA 3.0) via Commons Wikimedia

ncG1vNJzZmivp6x7pbXFn5yrnZ6YsqOx07CcnqZemLyue8OinZ%2Bdopq7pLGMm5ytr5Wau26u0ZqlnKBdlruledWsZKytkqi2pbXAq7Bo