Key Difference – Accounts Receivable vs Notes Receivable

The key difference between accounts receivable and notes receivable is that accounts receivable is the funds owed by the customers whereas notes receivable is a written promise by a supplier agreeing to pay a sum of money in the future. These are two principal types of receivables for a company and will be recorded as assets in the statement of financial position. Accounts receivable and notes receivable play an important role in deciding the liquidity position in the company.

CONTENTS

1. Overview and Key Difference

2. What is Accounts Receivable

3. What is Notes Receivable

4. Side by Side Comparison – Accounts Receivable vs Notes Receivable

5. Summary

What is Accounts Receivable?

Accounts receivable arises when the company has conducted credit sales, and the customers are yet to settle the amounts. Accounts receivable is usually considered as the most important current asset following cash and cash equivalents when liquidity is considered. Two important liquidity ratios can be calculated using accounts receivable amounts as follows.

Accounts Receivables Days

The number of days the credit sales are outstanding can be calculated using the following formula. The higher the number of days, this indicates possible cash flow issues since customers take longer to pay.

Accounts Receivables Days = Accounts Receivables / Total Credit Sales * Number of Days

Accounts Receivables Turnover

Accounts receivable turnover is the number of times per year that a company collects its accounts receivable. This ratio assesses a company’s ability to issue credit to its customers and collect funds from them efficiently.

Accounts Receivables Turnover = Total Credit Sales / Accounts Receivables

The more time customers take to settle debts increase the possibility of bad debts (nonpayment of due funds). Thus, it is vital for businesses to continuously monitor the accounts receivables. Accounts receivable aged analysis is an important report prepared that indicates the amount unsettled from each customer and for how long they have been unsettled. This will indicate any breaches of credit terms if there are any.

What is Notes Receivable?

Notes receivable refers to an asset of a bank, company, or another organization that holds a written promissory note from another party. In this situation, the company extending credit against a note receivable is referred to as the ‘payee’ of the note and would account for this amount as note receivable whereas the customer who has to pay against that note is referred to as the ‘maker’ of the note. The maker accounts for the amount as a note payable. The face value of the note is the amount offered as the loan. Notes receivable carry interest charges; thus, when the maturity date approaches, it can be extended if the company wish to accumulate more interest.

E.g. ADF Company lends $25,250 to one of the suppliers where the supplier agreed to pay the amount by signing in a written promise.

Notes receivable may be short term or long term. If the notes are paid within the current accounting year, it will be classified as short-term notes receivable or ‘current notes’, and if it is settled after the current accounting year, then it will be categorized as long-term notes receivable or ‘noncurrent notes’.

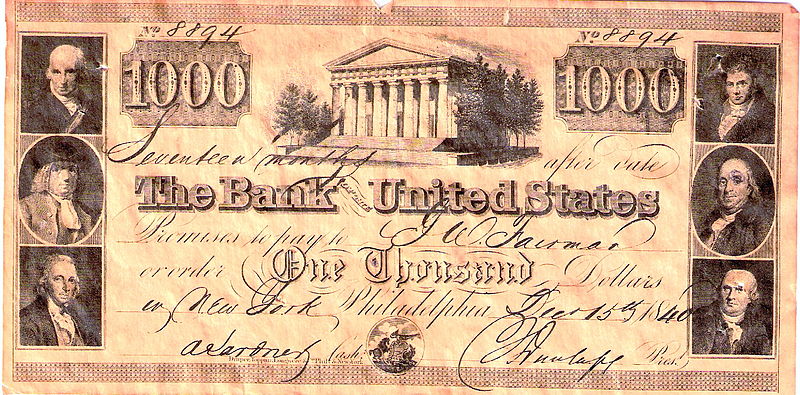

Figure 1: Promissory note is a legal signed document with a written promise to pay a stated sum to a specified person at a specified date or on demand.

What is the difference between Accounts Receivable and Notes Receivable?

Accounts Receivable vs Notes Receivable | |

| Accounts receivable is the funds owed by the customers. | Notes receivable is a written promise by a supplier agreeing to pay a sum of money in the future. |

| Time Period | |

| Accounts receivable is a short term asset. | Notes receivable may be short term or long term. |

| Legal Implications | |

| Accounts receivable does not involve a legally binding document. | Notes Receivable involves a promissory note (a document of legal value). |

| Interest | |

| Interest is not chargeable on accounts receivable. | Notes receivable charges interest. |

Summary – Accounts Receivable vs Notes Receivable

Both accounts receivable and notes receivable are vital for organizations especially from a liquidity point of view. The difference between accounts receivable and notes receivable is mainly decided based on the ability to receive interest and the availability of a legally binding document. The default risk of notes receivable is much less due to the legal status involved while the requirement to enter into a legal contract may often depend on the sum of credit given and the relationship the company has with the customers.

References:

1.”Accounts receivable vs. Notes Receivable.” Everything You Wanted To Know About Accounting, Finance, Money & Tax! N.p., n.d. Web. 20 Mar. 2017.

2.”Accounts Receivable – AR.” Investopedia. N.p., 31 July 2014. Web. 20 Mar. 2017.

3.”What is notes receivable?” AccountingCoach.com. N.p., n.d. Web. 20 Mar. 2017.

4.Marty Schmidt. “Receivables Including Accounts Receivable, Notes Receivable Explained.” Business Case Web Site. Solution Matrix Ltd, Publisher. 20 Mar. 2017. Web. 20 Mar. 2017.

Image Courtesy:

1. “Promissory note – 2nd Bank of US $1000” By Second Bank of the United States – (Public Domain) via Commons Wikimedia

ncG1vNJzZmivp6x7pbXFn5yrnZ6YsqOx07CcnqZemLyue8OinZ%2Bdopq7pLGMm5ytr5Wau26twpymrqakqHqzscKeoK%2BZkqGybq3NnWSvq12jvLWx0mapnpuVnsOirsueZg%3D%3D